EASE OF DOING BUSINESS

- Foreign companies have and enjoy the same treatment as national companies. Foreign investors may invest in any industry and are free to transfer funds, assets and other goods, including profit or dividend.

- The investors implementing investment projects in Montenegro are eligible for the financial incentives approved by the Government of Montenegro.

- Competitive tax system (general corporate profit tax and personal income tax is 9%) . Incentives and tax reliefs for investment on both national and local levels, including in purposefully established Business and Free Trade Zones.

- The term “foreign investor” applies to a company that has been set up in Montenegro by a foreigner, or foreign legal entity, whose share of investment capital is higher than 25% of total capital invested.

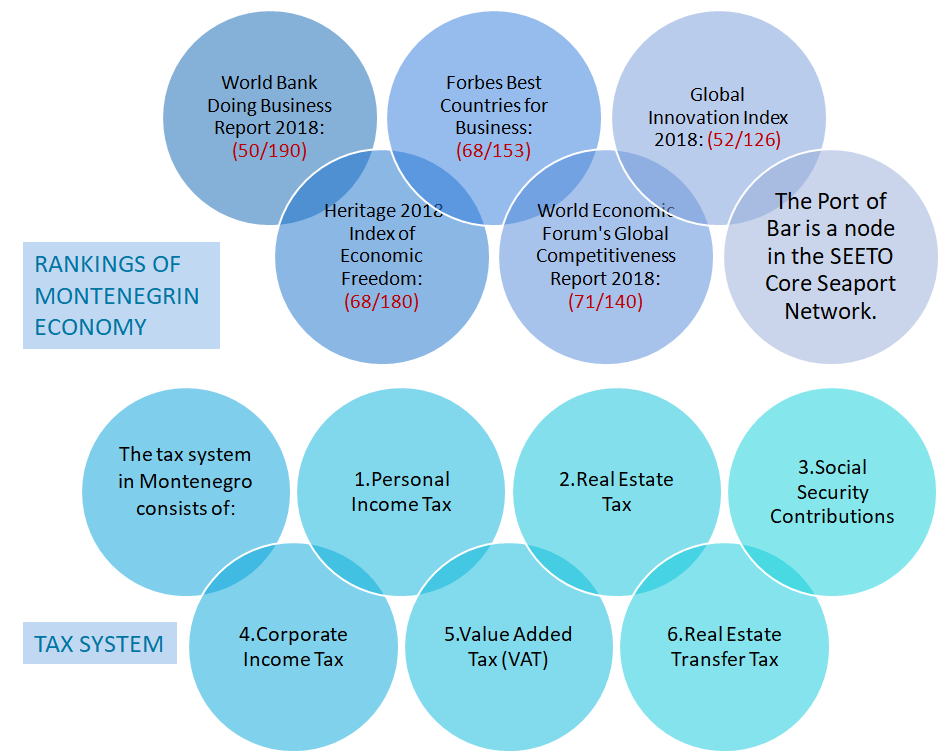

TRADE , TAX AND INCENTIVES

- As of December 1, 2018, Montenegro has 43 effective double taxation conventions on income and capital.

- There Is No Limit On The Amount Of Capital Invested In Montenegro.

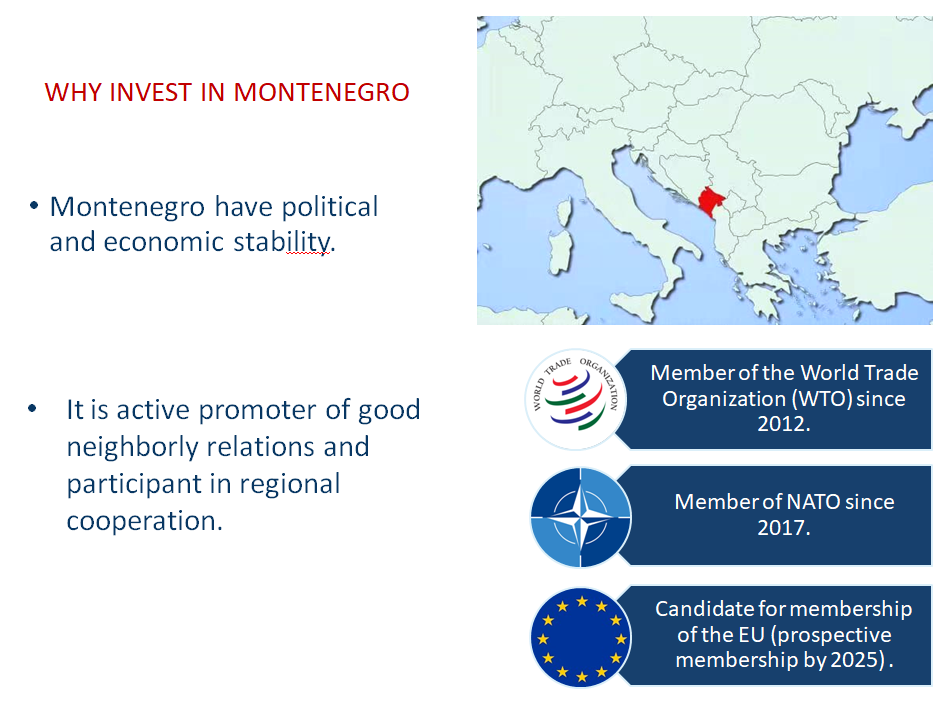

- Access to a market of around 800 million consumers owing to the free trade agreements with the EU (Stabilization and Association Agreement), CEFTA, EFTA, Russia, Turkey and Ukraine

- The tax system for foreign investors is the same as for local business entities.

- Corporate income tax is flat 9% and it is one of the lowest in Europe, while the tax rate on personal income is 9% or 11% (applicable on gross monthly wages above €765). Upon payment of the corporate income tax, business entities operating in Montenegro have the possibility to transfer funds to their accounts abroad at the end of the year.

REGISTER COMPANY IN MONTENEGRO

- The deadline for registration with the Commercial Court is a maximum of 4 days, while other duties (statistics – company registration number, entry into the tax records, opening a current account, registration in customs records) are completed within a maximum of 3 days.

Simple procedure for creating a company(four days and founding capital of €1) - Foreign legal and natural persons have the right to establish a company in Montenegro under the same conditions as nationals. The most common forms of companies are:▪ limited liability company (LLC)

▪ joint stock company (JSC)

LICENSE ISSUING

- REQUIREMENTS FOR ISSUING LICENSE

Intermediary Agent and International Due Diligence Agent are:- Not to be sentenced in Montenegro or in another state by a final and binding court decision or have a criminal case.

- Three year has preformed the same or similar activites in at least three countries on the basis of a contract or license.

LICENCE VALIDITY PERIOD AND COST

LICENCE VALIDITY PERIOD AND COST

One year validity period and may be extended twice for a period of one year per extension.

- The license for an International Due Diligence Agent is free of charge.

- The license for an Intermediary Agent is 50,000 € annually.

INVESTING AND BUSINESS STIMULATION

- The funds to incentivize investments are allocated following a public announcement. Eligible investment projects include

those of

those of

minimum worth of €500,000 which will generate at least 20 new jobs over the course of three years, from the date of signing the

agreement on the use of funds. - (in the Capital City and the southern region)

- Investing €250,000, which generate at least 10 new jobs

- (in the northern and central region, excluding the Capital City)

- In addition, any capital investment in excess of €10 million and generating at least 50 new jobs is eligible for incentives

- of up to 17% of its worth.

- The Decree envisages the possibility to reimburse the costs of construction of the infrastructure required to implement

- the investment project.

INVESTMENT OPPORTUNITIES

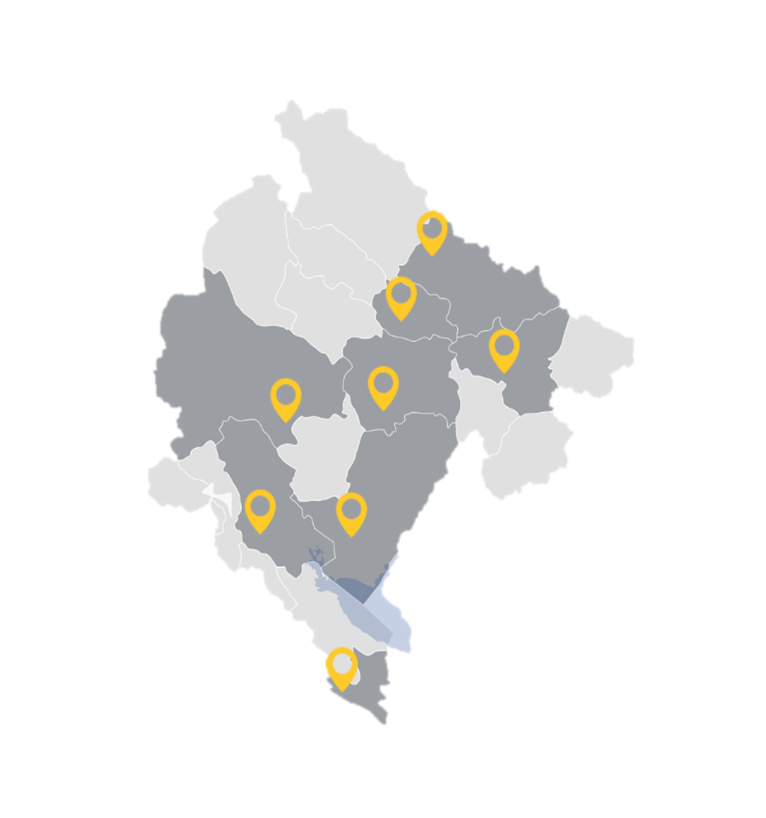

- The website www.investmentlocations.me provides detailed information on investment opportunities for specific locations in all 23 municipalities of Montenegro. The website also contains information on the overall investment environment and incentives and financial reliefs available to investors, including relevant contacts.

- The website www.bizniszona.me provides detailed information about the locations

declared as Business Zones in Montenegro, including their real estate and

infrastructure potential and incentives offered to prospective businesses

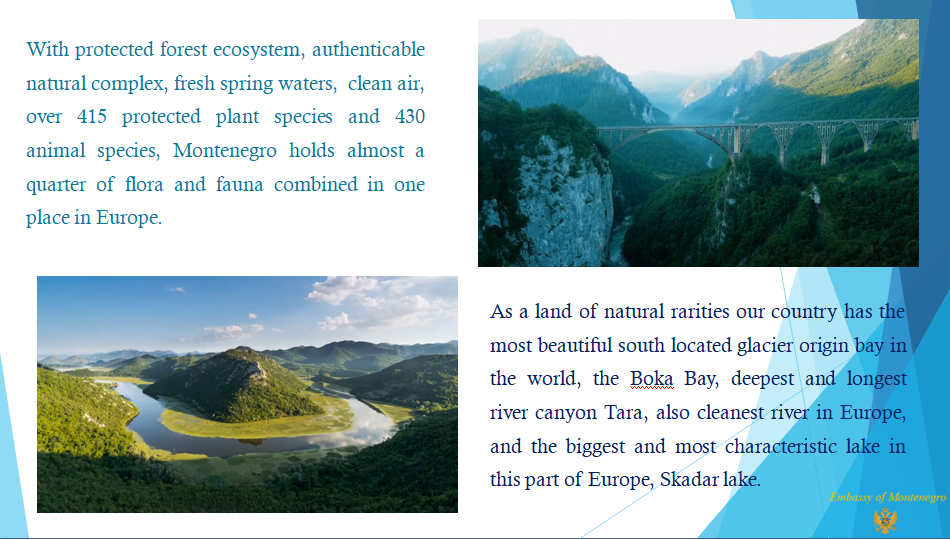

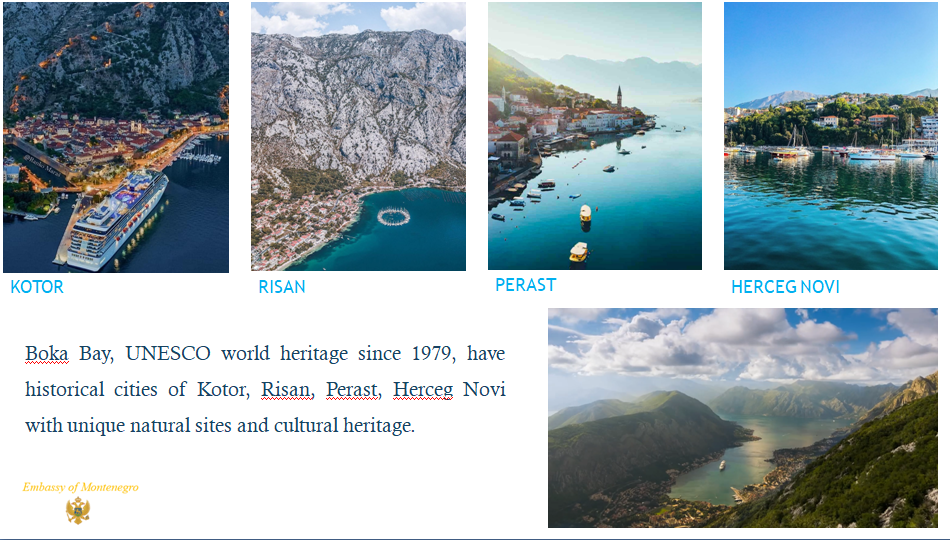

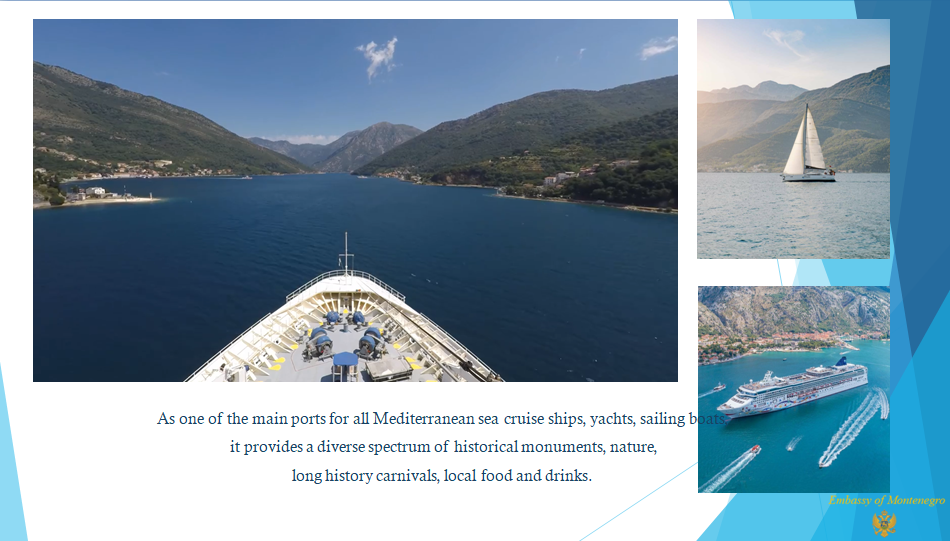

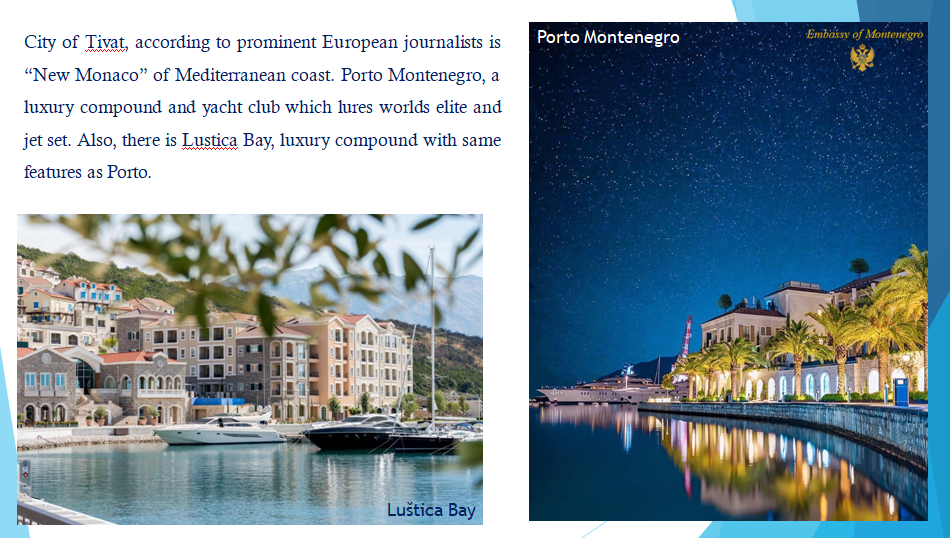

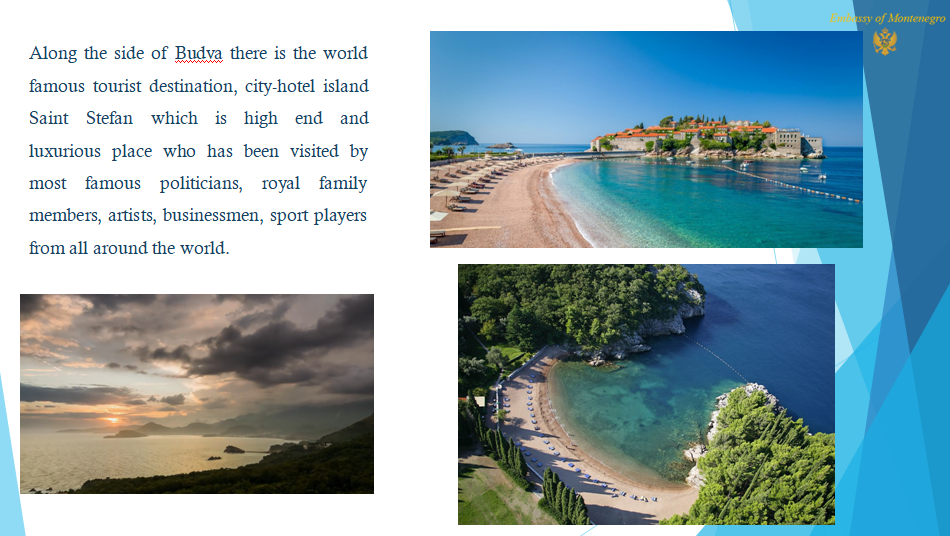

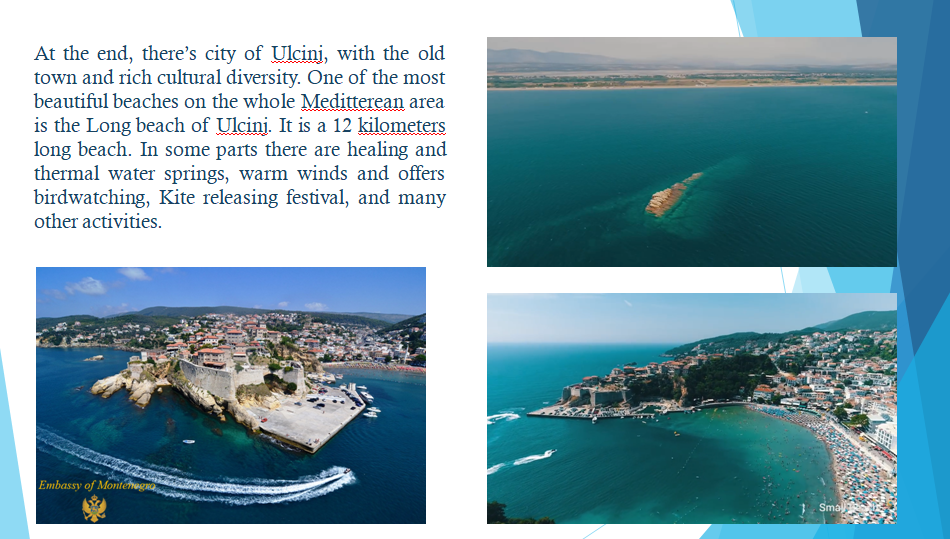

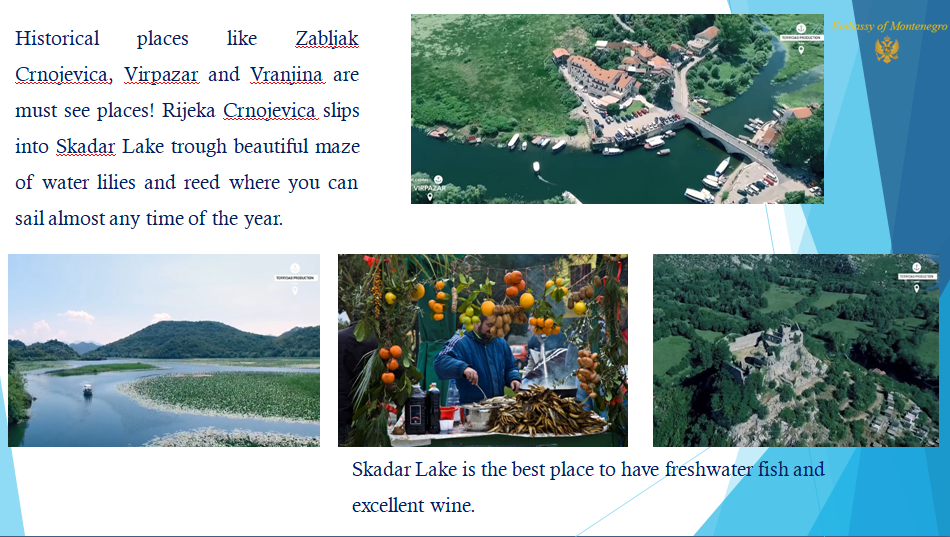

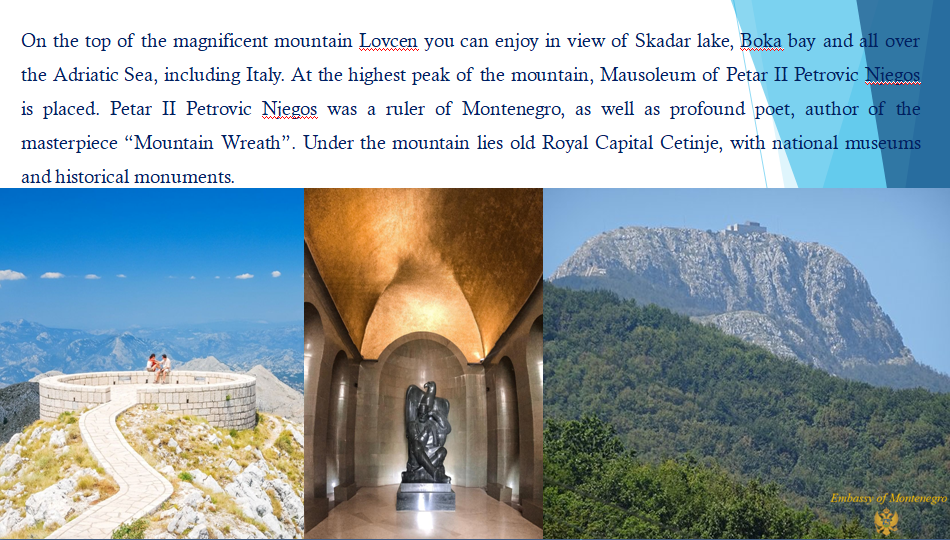

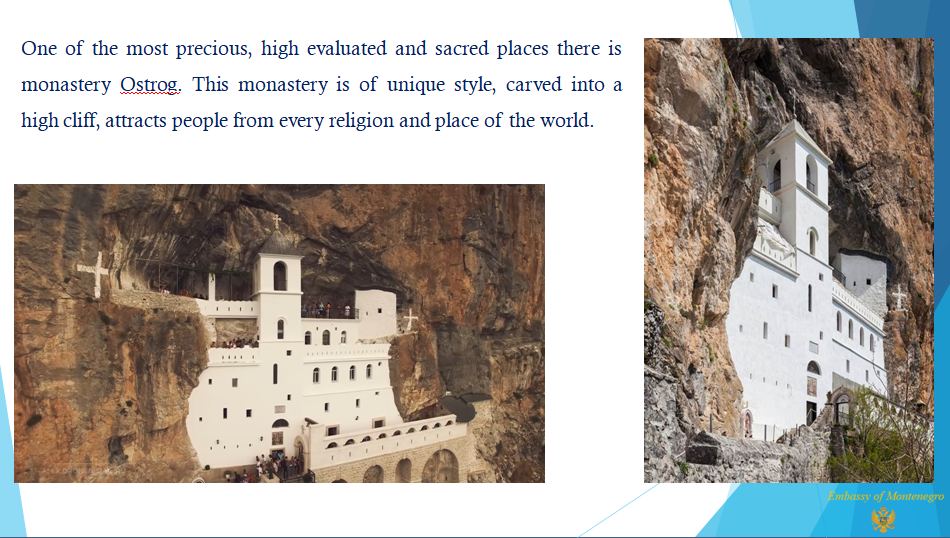

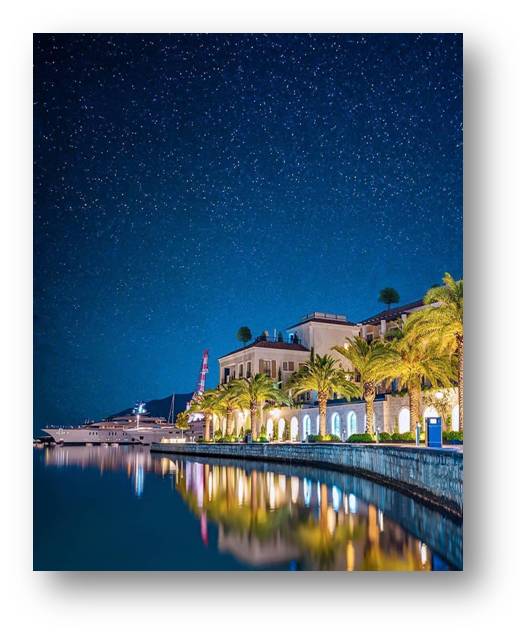

TOURISM AND HIGH-END INVESTMENTS

- Tourism is the most dynamic sector in Montenegro with investment opportunities in the

construction and operation of high-end hotels, congress centres, resorts, golf courses,

upscale shopping centres, entertainment facilities, etc. - With the aim to eliminate business barriers and incentivize high-end tourism, the Law

Amending the Law on Real Estate Tax allows local governments to lower the tax rate for

the hospitality establishments that operate throughout the year by up to 30% for the 4-star

ones and up to 70% for those with more than 4 stars.

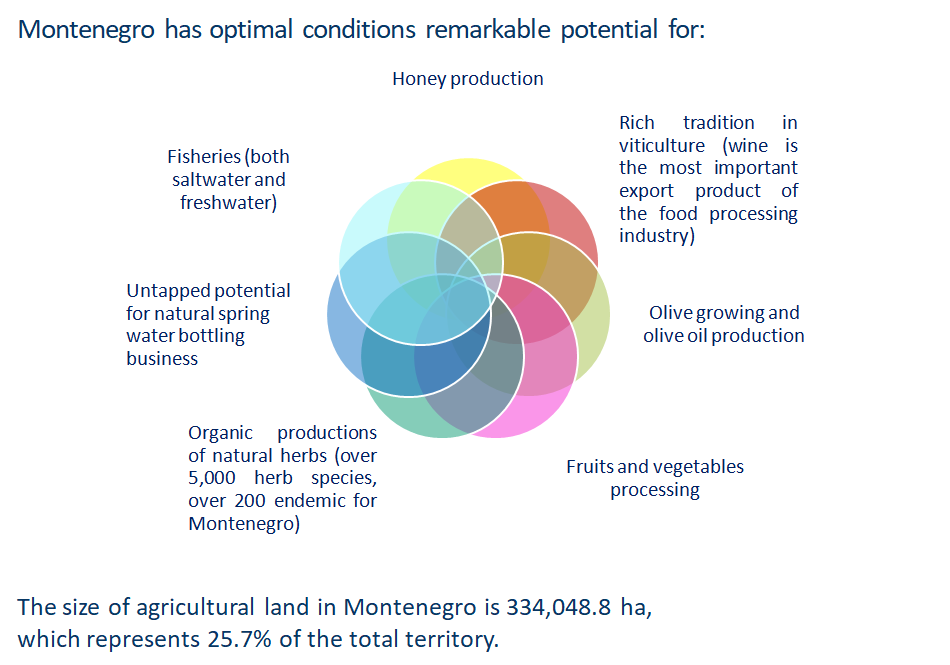

AGRICULTURE AND PRODUCTION

ENHANCING DEVELOPMENT

MAIN CONTACTS AND USEFUL LINKS

- Government of Montenegro: www.gov.me Twitter: @MeGovernment

- Ministry of Foreign Affairs: www.mvp.gov.me Twitter: @MFA_MNE

- Economic and Cultural Diplomacy

http://www.mvp.gov.me/rubrike/ED/Ekonomska-diplomatija/

- Embassies and Consulates of Montenegro:

http://www.mvp.gov.me/en/sections/Missions/Embassies-and-consulates-of-Montenegro/

- http://www.mipa.co.me/dcs/THE_FOREIGN_INVESTMENT_LAW.pdf

- Chamber of Economy of Montenegro: www.privrednakomora.me/en

- Central Bank of Montenegro: www.cb-cg.org

- Montenegro e-tenders: http://www.etenderi.me/

- Association of Banks in Montenegro – http://ubcg.info/en/